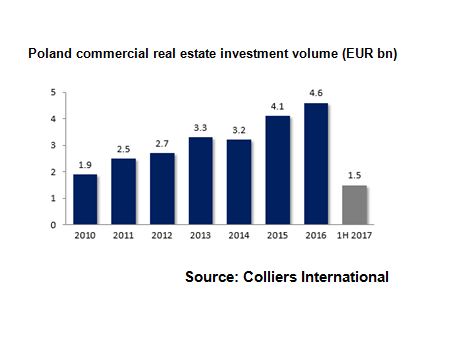

Polish real estate investment volumes for 2017 may surpass the record of €4.6 bn transacted last year, according to Colliers International.

'Poland generates interest from large global funds. Economic potential, legal system stability and size of urban areas speak in favour of the Polish market, said Piotr Mirowski, head of investment services at Colliers International.

'Some international players have begun to classify Poland as "core" market, which is characterised by stability and a low risk level. Poland's share in the European commercial real estate market should continually increase in the years ahead,' Mirowski said. 'Commercial real estate transaction volume for the whole 2017 may climb to new record high. In my view, 2018 will be another year of growth, however, a lot will depend on the availability of properties for sale.'

In a new report on the last 20 years of real estate investment in Poland, Colliers International writes:

From emerging to core market

Polish commercial real estate was at the initial phase of development in the middle of the 1990s. Back then, there were no proven regulations that would guarantee stability. This, combined with low liquidity, was associated with the exposure to greater risk, and therefore the investors took a short-term investment horizon or allocated money to other markets.

Poland's accession to the European Union in 2004 was a breakthrough, which made the country credible in the eyes of foreign investors and triggered substantial interest in the commercial real estate industry. Inflow of capital from the EU structural funds and growth perspectives for the Polish economy drove investment activity. At the peak moment, the value of transactions concluded in Poland reached €4.5 bn in 2006.

The global financial crisis of 2008/09 undermined the confidence in the global financial sector and real estate market, and the negative mood affected also Poland. In effect, there was muted demand of international funds for commercial real estate on the Polish market. This resulted in significant decrease in the investment volume to €790 mln from record high €4.5 bn three years earlier.

The market was dominated by lack of liquidity among investors and among banks providing financing for new projects. Deadlock, however, didn’t last long, as at the beginning of 2010 there was a gradual increase in the value of concluded transactions. Moreover, the investment volume reached new high at €4.6 bn in 2016, of which €1.8 bn came from South African investors.

Spectacular transactions

In recent years, Colliers International advised some on the most spectacular investments in commercial real estate in Poland and Central and Eastern Europe. For instance, Colliers provided commercial advise for the acquisition of Echo Investment’s controlling stake by joint venture between Griffin Real Estate/Oaktree and PIMCO back in 2015.

Over the last 20 years, the structure of investor origin has changed. Today, funds from the UK, Germany or the US are not the only ones investing in Poland. There is an increasingly number of buyers from the South Africa and Asia (Malaysia, South Korea, Singapore).

Chinese investors also marked their presence in Poland, and more investors from outside of Europe may follow suit, as funds from Canada and Australia are considering the purchase of real estate assets in Poland.

Regions growing in importance

'Investors more and more eagerly invest in smaller Polish cities. In 2010, transactions worth EUR 1.7 bn were concluded in Poland, 80% of which was invested in Warsaw, while 20% was allocated to regional markets. In 2016, this proportion shifted, as ca. 75% of capital was invested in regional markets, and Warsaw’s share in the transaction volume decreased to ca. 25%.

This shift predominantly reflects increasing investors' confidence in regional markets, but it also stems from the lack of suitable investment products in Warsaw available for sale.

Prime yield for best office buildings in Warsaw is currently at ca. 5.25%, whereas in regional markets it stands at ca. 6%. When it comes to shopping centres in Warsaw and regional markets, yield is currently at 5%, and in smaller cities it’s between 6.5% and 8%, depending on the population and scheme's position in the local market.