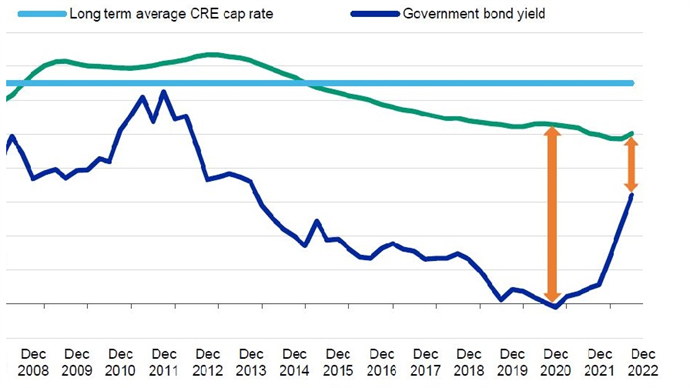

Reviewing their debt financing strategy is the highest priority for many investors, as interest rates continue to rise and values start to fall.

MAGAZINE Market grapples with refinancing issues

- In Magazine highlights

- 09:22, 28 november 2022

Premium subscriber content – please log in to read more or take a free trial.

Events

Latest news

Best read stories

-

CDC Investissement Immobilier and Covivio link up on German residential

- 23-apr-2024

CDC Investissement Immobilier, the real estate asset management subsidiary of French financial institution Caisse des Dépôts, has inked a strategic partnership with Covivio in Germany.

-

-

- 23-apr-2024

Commerz Real acquires solar projects in Sweden

-

-