Only £800 mln (€900 mln) of new UK assets launched to market in March according to a new liquidity tracker from C&W, highlighting the extent of Covid-19’s impact on property investment.

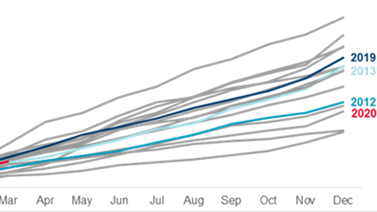

The report also reveals the first quarter of 2020 has been the weakest from an investment perspective since 2013 with just £11.4 bn worth of assets exchanging hands up to the end of March.

The ‘Cushman & Wakefield Commercial Real Estate Liquidity Tracker’ is currently monitoring more than £17 bn of UK product. Covering single assets valued at more than £5 mln it is estimated to capture more than 50% of the market.

The tracker showed that following the General Election result at the end of last year and the UK’s confirmed exit from the EU in January, there was a resurgence in the number of assets available. However, the growing global impact of Covid-19 has resulted in a drastic downturn in the number of deals being completed as well as new assets coming to the market. The £11.4 bn of transactions which did complete in Q1 was 14% down on the same period in 2019.

The data also showed that at the end of March, close to £7 bn of new stock had been offered to the market so far this year, more than in the same period last year, with the offices and retail assets accounting for 80% of supply. Institutional, retail funds and property companies were the principal sellers and currently nearly £6 bn of assets were currently under offer or exchanged. However, only £0.8 bn of new stock was offered to the market in March compared with £1.9 bn in the same period last year.

The analysis shows the number of assets being withdrawn altogether remains relatively low to date. This is starting to increase particularly for smaller lot sizes, but also excludes a number of portfolios, which are not covered by the liquidity tracker.

From a pricing perspective, assets which completed in the first quarter of 2020 traded at an average 2% discount to quoting versus 2.4% in Q4 2019. Industrial and alternative assets continue to trade at a premium with offices largely meeting their quoting price or beyond in places such as Central London. Retail assets faced steep discounting. Signs of risk aversion were seen with average quoting yield beginning to fall again in March to 5.7%, although still above low of 5.3% in November of last year.

Nigel Almond, head of Data Analytics, EMEA Research & Insight at Cushman & Wakefield, said: ‘The liquidity tracker is already showing the immediate and far-reaching impact the current Covid-19 crisis is having on the commercial real estate market in the UK. Moving forward we expect a limited amount of new product to come to the market with continued downward pressure on pricing. A lack of debt coupled with an inability to inspect buildings will also lead to sales progressing more slowly or being placed on hold.’

He added: ‘A number of equity buyers remain in the market able to transact, with bids still being called on some assets, with the hope that progress can be made and to allow completion when restrictions ease. Inevitably we are now seeing a growing number of deals placed on hold or being withdrawn from the market as uncertainty over pricing persists. While some deals under offer will continue, others will stall increasing the rate of withdrawals.’