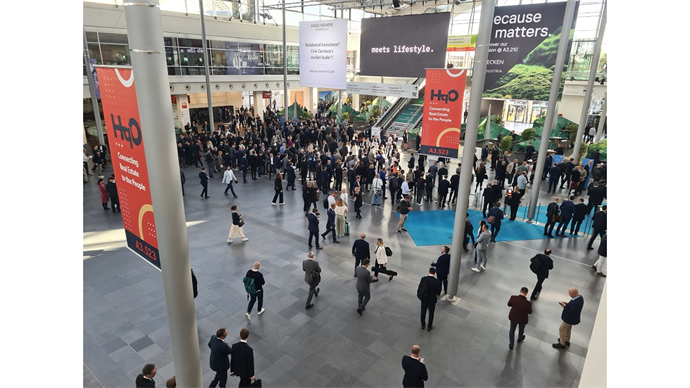

If Day One of Expo Real 2023 saw delegates pour enthusiastically into Munich’s fairgrounds, it was hard to say how much actual business they expected to do with dealmaking at an all-time low.

Union Investment Real Estate spokesman Fabian Hellbusch said he was anticipating a ‘shift towards asset management themes’ at the event, such as ‘extracting value from currently held assets, and eventually, future project developments – preparations for the next real estate cycle’.

Germany’s institutional investor base, which is usually well-represented at Expo, typically takes a risk-averse approach to transactions even in boom times. The current climate has inspired further circumspection, as noted by Michael Bütter, CEO of Union Investment Real Estate: ‘Against the backdrop of rising risks in the real estate markets, our investor mandate currently requires us to take a cautious investment course.

‘In the new interest rate environment, new opportunities will arise as market momentum increases again. And we currently see numerous opportunities, particularly in the European core markets, which we will exploit in a targeted manner,’ Bütter said.

Firms with open-ended funds have to be especially shrewd in keeping dry powder, of course, in case of investor redemptions. But the theme of market turgidity was evident among other players, with founder and managing partner of Germany’s Aventos, Karim Rochdi, questioning if even private equity firms were managing to do deals. ‘Even they seem to be sitting on the sidelines,’ he said, ‘with pricing still not there.’

Rochdi added that he was focusing on meeting ‘present and future tenants’ for Aventos’ logistics assets at Expo, with cashflow more critical than ever. ‘It’s still hard to find good deals on the market due to the gap between sellers and buyers’ expectations. That leaves us concentrating on our existing assets and developments, and lining up future occupiers.’

Logistics success

Diana Oblak, managing director of Stoneweg’s Swiss business, agreed that the bid-ask spread remained a sticking point for the capital markets. ‘Sellers are thinking about yesterday, we are thinking about tomorrow, and we haven’t met in today yet,’ she said. But she confirmed that her firm’s successful logistics platform was developing several projects in response to the sector’s solid fundamentals and the prospect of better days ahead.

The firm recently launched its first ever Beezi scheme – a logistics model with shared amenities and a flexible dimension – and is working on another four iterations of the pioneering project. ‘Demand for logistics premises has remained high,’ she said.

Pan-European player Verdion was a little more optimistic about the opportunity to do deals. ‘Expo Real comes at a key moment in the real estate cycle,’ said Michael Hughes, Verdion’s CEO. ‘The economic shocks of the past year have created some outstanding investment opportunities: this is the time for the true sector specialist.

‘Asset re-pricing is still playing out in some of our geographies, but generally there is now far greater market certainty on valuation, and the fundamental strengths of investing in logistics real estate remain consistently sound.’

Retail’s return

While sectors including offices and retail have taken a hit in recent years, proponents of each asset class had something positive to say at Expo. Eric Decouvelaere, head of retail EMEA at CBRE Investment Management, pointed out that certain retail assets were displaying ‘impressive fundamentals’, with ‘sales way ahead compared to 2019, and footfall getting closer to 2019 levels’.

However, he said that the polarisation of the asset class was more manifest than ever, with ‘dominant’ assets pulling away into an unreachable lead. ‘Discerning investors will have to be very careful and resist some bargains which are now not matching what retail needs,’ he added. ‘It’s always the same equation: right location, relevant proposition, strong execution. If you build relevance, you can build dominance.’

Another asset class in the doldrums, offices, also found its defenders at Expo. Shravan Joshi, chairman of the City of London’s planning and transport committee, told PropertyEU that there was still plenty of evidence that more offices would need to be constructed in the Square Mile. He said that employment in the area had risen since 2019, and despite the rise of hybrid working models, as much as another ‘1.9 million m2 of space’ would be needed by 2040.

‘We have 10 tall towers at various stages of planning, and occupancy metrics for the area’s largest buildings are impressive. 22 Bishopsgate is 100% let, while 8 Bishopsgate is 75% let; of the buildings that are coming through, the new towers are pre-let to around 45%.

‘We think that the Elizabeth Line is helping massively with that, with our infrastructure measures acting as a big magnet.’

Tech taking a back seat

Expo Real has been one of the industry’s strongest proponents of proptech solutions in recent years, and three dozen start-ups once again gathered in the fair’s Tech Alley space. Yet, as of Wednesday morning, the mood here felt a little muted.

In a tough economic climate, funding has visibly decreased for proptech. But firms developing tech argue that its solutions are more important than ever in a scenario of low margins and an acute need for innovative asset management.

AI-powered real estate data platform Stonal is distributing a white paper on automation at Expo, a solution which CEO Robin Rivaton said would be key to improving workflows. ‘Unreliable data remains a major roadblock to improving liquidity; without it, asset managers cannot be expected to make good decisions,’ he said.

According to Rivaton, automation should drastically alter how asset managers work, improving decision-making and liquidity, ultimately accelerating a ‘lethargic’ market. ‘We hope legislation continues to support the development of this technology for real estate, in a safe and sustainable way,’ he said, referring to the upcoming EU legislation on AI, which is expected to be published by the end of the year and have a significant impact on how tech is used in real estate.

Ben Yexley, head of business development at AI platform Askporter, expanded on the topic, explaining that the EU AI Act will bring forward legislation regarding data protection, and additional compliance legislation around public interaction.

‘We’re heading into a critical few months for the future of artificial intelligence in Europe. The built environment is significantly dependent on data and has already gone some way to integrating AI software within all aspects of the market, whether that be in facilities management, asset management or construction,’ Yexley told PropertyEU.

For Yexley, it will be vital to promote a ‘responsible use of AI’ to improve public confidence in the technology, but he warned that heavy-handed legislation could ‘stifle the growth of a burgeoning sector which has the potential to transform the industry’. He added: ‘An ideal outcome would be sensible and realistic policies which provide safety for consumers, but space for innovation for businesses.’