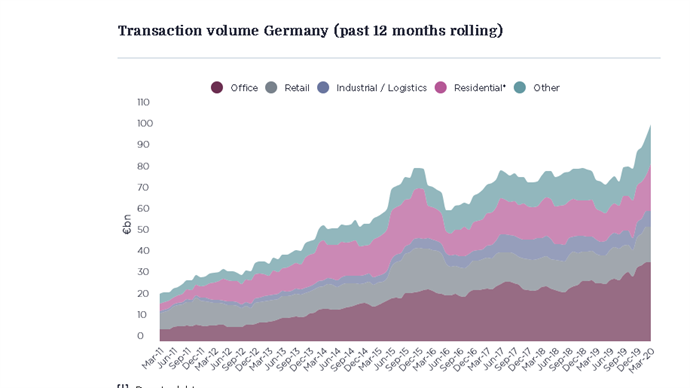

The Covid-19 pandemic has brought the German commercial real estate market’s 10-year cycle to an end, with broker Savills anticipating a significant slowdown after the country closed with the highest first-quarter transaction volume ever recorded.

According to Savills, overall investment volumes totalled more than €18.4 bn between January and March 2020, an increase of 72% year-on-year.

The broker however expects a significant decline in investment activity over the coming weeks and months. ‘Scarcely any further sale processes are now being initiated,’ commented Marcus Lemli, CEO Germany and head of Investment Europe for Savills. ‘While there are a number of investors who want to make further acquisitions, they are faced with practical hurdles such as the prevailing lockdown restrictions. Many other investors have put their acquisition plans on hold for the time being and intend to use the coming weeks to take stock.’

Looking ahead to the remainder of the year, Savills anticipates that transaction volumes will be significantly lower in the second quarter and that overall investment for 2020 will be unable to match the figures from recent years. In the short term, the international real estate advisor expects initial yields to soften across practically all sectors, with investors likely to revise their rental growth expectations downwards in view of the substantial disruption to the economy. Market access is currently interrupted for many foreign investors which will reduce demand.

Lemli said: ‘All market participants are proceeding with caution and will continue to do so over the coming weeks. We are all witnessing a historic event whose outcome is open-ended. This offers risks and opportunities but, above all, uncertainty for the time being. In such an environment, it is difficult to make decisions with long-term implications such as property investments. Investors with large liquidity cushions are at an advantage, particularly since debt capital will become scarcer. Such investors will be in a good starting position to exploit the opportunities that arise.’

Matthias Pink, head of Research, Savills Germany, added: ‘Experience of previous crises shows that initial yields softened consistently across all sectors, with more softening for non-core products compared to core products. The same is likely to happen this time, but we are currently unable to estimate the extent to which yields will soften and for how long.’