Star firms managed to add to AUM in 2020 despite one of the toughest years in history, as global economies recoiled amid Covid-19.

After a turbulent start, the real estate market weathered the shock of the coronavirus pandemic better than anyone had envisaged, for the most part.

PropertyEU’s annual survey of the Top 100 investors shows the total volume of assets under management (AUM) at year-end 2020 was virtually unchanged at €1,858 bn. The difference from 2019’s figure of €1,904 bn is almost entirely accounted for by the decision of last year’s fourth-placed investor, Credit Suisse, to opt out of the survey. Had the investment bank’s figures been included, the final tally would probably have reflected a small overall increase.

There was strong continuity among the major players, with the top 50 companies in 2020 all drawn from last year’s top 60. Large investors with deep pockets were able to ride out the Covid storm. Meanwhile, it was at the lower end that the effects could be seen: of the 29 companies whose AUM shrank during the year, 12 were ranked 85th or lower.

Dig deeper, and other significant trends become clear. The retail sector, already under pressure from the rise of e-commerce, was hit hardest of all by the lockdown, with Unibail-Rodamco-Westfield recording only 70 days of normal operations – mostly in the first quarter of 2020.

The UK lost one of its largest retail investors, Intu, while its erstwhile rival Hammerson struggled. Hammerson reduced AUM to €7 bn from €9.7 bn in 2019 amid the disappearance of many high street names, including Debenhams, and agreements to defer rental payments.

Top regions

The impact of Brexit cannot be ignored. In our 2017 survey the UK was the largest real estate market in Europe, with 22 British-based companies in the Top 100 and 21.3% of the aggregate AUM. Last year that number diminished to 14, comprising 12.5% of all assets, leaving the UK clearly in third place behind France and the new powerhouse of Europe, Germany.

Germany is the most important country in terms of being the home to companies with the largest aggregate AUM. It has a 24% share of the pie, given German investors have a combined €459 bn of AUM. France is next with 19% of the pie, then Brexit-hit UK on 12.5%, the US (11%), Switzerland (8%), Sweden (5%), the Netherlands (3%), Italy (3%), and Canada (2.98%).

Star performers

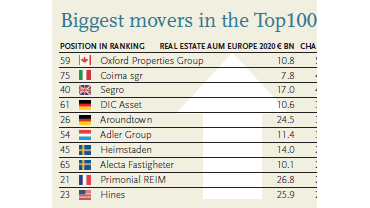

There have been some eye-catching performances. For example, Oxford Properties Group, which is part of Omers, one of Canada’s largest defined benefit pension plans, attacked 2020 with gusto to become the biggest riser. During 2020, Oxford’s executive VP of Europe and Asia Pacific, Jo McNamara, said the company had decided logistics would continue to be one of its ‘highest conviction strategies globally’, thanks to secular shifts underpinning the sector. It struck numerous deals as part of a planned €3 bn spree into European logistics over the next five years. During the year, it agreed terms to acquire M7 Real Estate, giving it scale to deploy that €3 bn.

Germany’s Aroundtown was another star performer, making it to 26th place on the ranking having added 35% to its 2019 AUM. The listed company experienced a momentous 2020 as it took over TLG Immobilien to enlarge its footprint in offices, hotels and residential property, primarily in Germany and the Netherlands.

Notable gainers

Italy’s Coima (+47%), Segro (+41%), DIC Asset (+39%), Adler Group (+32%), Heimstaden (+28%), Alecta Fastigheter (+27%), Primonial REIM (+27%), and US firm Hines (+27%) also show up strongly in the top 10 ranking for AUM growth.

This growth is remarkable given it was achieved during a weird year of lockdowns and total upheaval thanks to the pandemic. It should be pointed out, however, that three of the top 10 gainers were also present in the top 10 risers for the 2019 edition – they are DIC (top in 2019 with 35%), Aroundtown (3rd with 27%), and Primonial (6th with 21%). So, their growth cannot be called opportunistic as they were clearly already pursuing a strategy of expansion. Rather, it shows that certain companies have remained able to add assets even during times of restricted travel and/or had a huge Q1 2020.

Having boots on the ground in key markets has been the key way to continue operating effectively at speed. It is perhaps worth highlighting that Germany’s Vonovia looks certain to figure very highly in the 2021 ranking after its planned takeover of Deutsche Wohnen seems likely to happen.

As PropertyEU stated on the front cover of its September 2021 magazine, this is a huge development in European real estate, and one that is likely to propel Vonovia to an AUM of around €90 bn next time. This will catapult it to second place in next year’s ranking, barring any other mammoth M&A deal between now and the end of 2021 involving other companies.

Changes at the top

But back to the 2020 ranking; there was no change to first and second place. Swiss Life Asset Managers remains the company with the largest real estate AUM in Europe, at €97.5 bn, followed by AXA IM Alts in second position on €69.1 bn (still a large way down on Swiss Life). Vonovia moves into third from fifth slot.

Big climbers include DWS – Real Estate (which PropertyEU profiled in the June issue). The listed asset manager, whose largest single shareholder is Deutsche Bank, broke into the top 20 on the back of a big focus on residential property. Corestate Capital has nudged into the top 20, having been in 22nd spot in 2019.

Swiss Life, remaining at Number One, said in the second half of 2020 that the global economy had cooled, which would impact tenant demand, especially in the office, retail, light industrial and hotel sectors. Residential, however, is generally less prone to economic cycles.

‘With interest rates remaining low, the relative attractiveness of real estate investments is still intact,’ it said. The main risks, it added, remain lack of good quality assets, increasing transaction prices due to high demand, and growth in regulatory density.

See PropertyEU's October issue for the full ranking and profiles